Revenue Up 12%, Net Income Up 33%; Expands Share Repurchase Program

ST. LOUIS (May 5, 2016) – Perficient, Inc. (NASDAQ: PRFT) (“Perficient”), the leading digital transformation consulting firm serving Global 2000® and other large enterprise customers throughout North America, today reported its financial results for the quarter ended March 31, 2016.

Financial Highlights

For the quarter ended March 31, 2016:

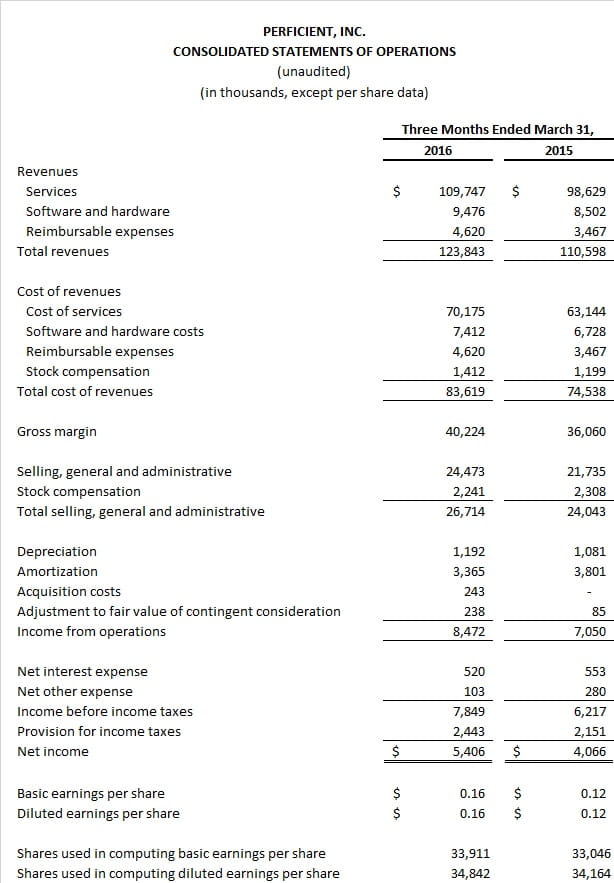

- Revenue increased 12% to $123.8 million from $110.6 million for the first quarter 2015;

- Services revenue increased 11% to $109.7 million from $98.6 million for the first quarter 2015;

- Gross margin increased 12% to $40.2 million from $36.1 million for the first quarter 2015;

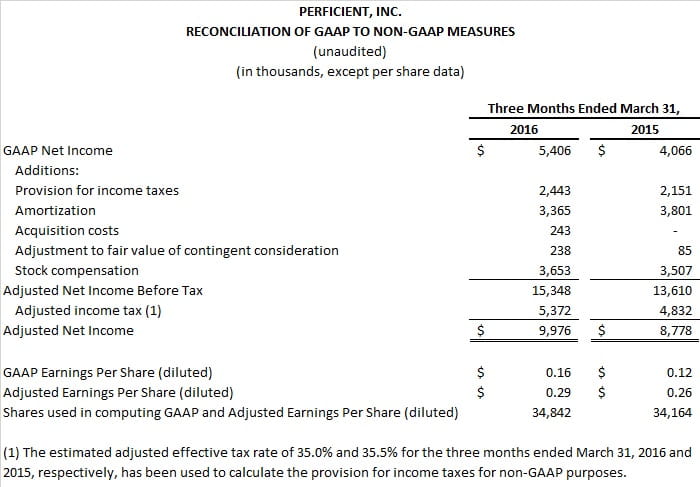

- Adjusted earnings per share results (a non-GAAP measure; see attached schedule, which reconciles to GAAP earnings per share) on a fully diluted basis increased to $0.29 from $0.26 for the first quarter 2015;

- Earnings per share results on a fully diluted basis increased to $0.16 from $0.12 for the first quarter 2015;

- Net income increased 33% to $5.4 million from $4.1 million for the first quarter 2015.

“Solid performance and record sales in Q1 have laid the foundation for a strong year of growth for Perficient,” said Jeff Davis, chief executive officer and president. “The world’s most innovative enterprises continue to partner with Perficient on digital experience, business optimization, and industry solutions to drive business success. We expect the recent launch of our full-service digital agency, Perficient Digital, to be a significant contributor in the months and years ahead.”

Other Highlights

Among other recent achievements, Perficient:

- Launched a full-service digital agency, Perficient Digital, to deliver exceptional, transformative customer experiences and expand Perficient’s capacity to deliver creative solutions that scale across complex businesses;

- Formally unveiled a newly-expanded Domestic Delivery Center facility in Lafayette, La., to complement Perficient’s Global Delivery Center network and strategy;

- Received recognition as a leading vendor for API strategy and delivery from independent technology and market advisor Forrester Research;

- Entered into a multi-year partnership with Major League Baseball’s St. Louis Cardinals that includes a variety of high-profile marketing and corporate engagement benefits;

- Added new customer-relationship and follow-on projects with leading companies such as Ancestry.com, Baylor Scott & White Health, The Bon-Ton Stores, Ford Motor Credit Co., GoPro, Herman Miller, NextGen, PCCA, Sports Endeavors, and Varsity Spirit; and

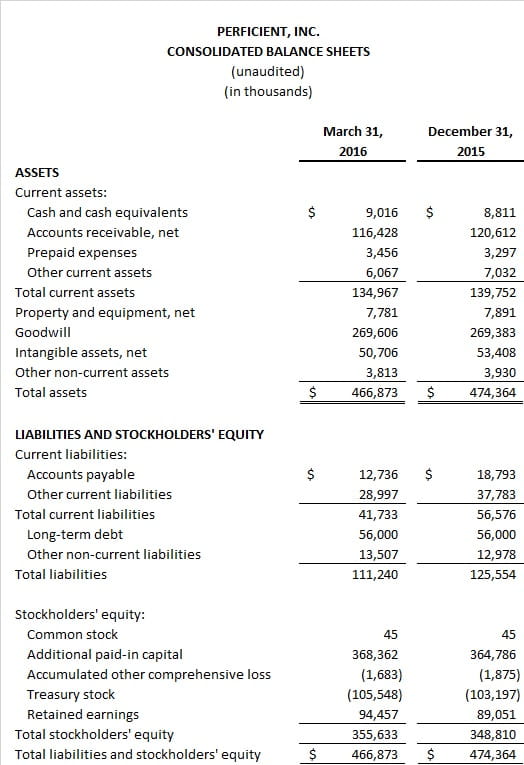

- On May 3, 2016, Perficient's Board of Directors expanded Perficient's stock repurchase program by authorizing the repurchase of up to additional $10.0 million of our common stock for a total repurchase program of $110.0 million and extended the expiration date of the program from June 30, 2016, to December 31, 2017. Since the program's inception in 2008, Perficient has repurchased a total of 9.6 million shares at a cost of $84.4 million.

Business Outlook

Perficient expects its second quarter 2016 services and software revenue, including reimbursed expenses, to be in the range of $119 million to $129 million, comprised of $113 million to $119 million of revenue from services (including reimbursed expenses) and $6 million to $10 million of revenue from sales of software. The midpoint of second quarter 2016 services revenue (including reimbursed expenses) guidance represents growth of 15% over second quarter 2015.

Conference Call Details

Perficient will host a conference call regarding first quarter 2016 financial results today at 10 a.m. Eastern.

WHAT: Perficient Reports First Quarter 2016 Results

WHEN: Thursday, May 5, 2016, at 10 a.m. Eastern

CONFERENCE CALL NUMBERS: 866-515-2911 (U.S. and Canada); 617-399-5125 (International)

PARTICIPANT PASSCODE: 29619590

REPLAY TIMES: Thursday, May 5, 2016, at 2 p.m. Eastern, through Thursday, May 12, 2016

REPLAY NUMBER: 888-286-8010 (U.S. and Canada) 617-801-6888 (International)

REPLAY PASSCODE: 39724959

About Perficient

Perficient is the leading digital transformation consulting firm serving Global 2000® and enterprise customers throughout North America. With unparalleled information technology, management consulting and creative capabilities, Perficient and its Perficient Digital agency deliver vision, execution and value with outstanding digital experience, business optimization and industry solutions. Our work enables clients to improve productivity and competitiveness; grow and strengthen relationships with customers, suppliers and partners; and reduce costs. Perficient's professionals serve clients from a network of offices across North America and offshore locations in India and China. Traded on the Nasdaq Global Select Market, Perficient is a member of the Russell 2000 index and the S&P SmallCap 600 index. Perficient is an award-winning Premier Level IBM business partner, a Microsoft National Service Provider and Gold Certified Partner, an Oracle Platinum Partner, an Adobe Business Solution Partner, and a Gold Salesforce Consulting Partner. For more information, visit www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are not purely historical statements discuss future expectations or state other forward-looking information related to financial results and business outlook for 2016. Those statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on management’s current intent, belief, expectations, estimates, and projections regarding our company and our industry. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward-looking statements include (but are not limited to) those disclosed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2015 and the following:

(1) the possibility that our actual results do not meet the projections and guidance contained in this news release;

(2) the impact of the general economy and economic uncertainty on our business;

(3) risks associated with the operation of our business generally, including:

a) client demand for our services and solutions;

b) maintaining a balance of our supply of skills and resources with client demand;

c) effectively competing in a highly competitive market;

d) protecting our clients’ and our data and information;

e) risks from international operations including fluctuations in exchange rates;

f) obtaining favorable pricing to reflect services provided;

g) adapting to changes in technologies and offerings;

h) risk of loss of one or more significant software vendors;

i) making appropriate estimates and assumptions in connection with preparing our consolidated financial statements;

j) maintaining effective internal controls; and

k) managing fluctuations in foreign currency exchange rates;

(4) legal liabilities, including intellectual property protection and infringement or personally identifiable information;

(5) risks associated with managing growth organically and through acquisitions; and

(6) the risks detailed from time to time within our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. This cautionary statement is provided pursuant to Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release are made only as of the date hereof and we undertake no obligation to update publicly any forward-looking statement for any reason, even if new information becomes available or other events occur in the future.

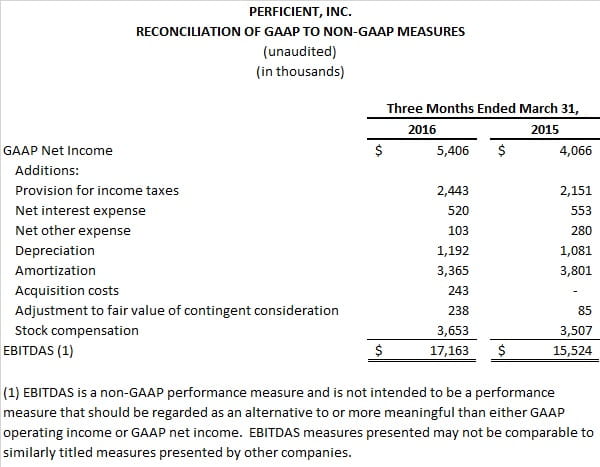

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”), please see the section entitled “About Non-GAAP Financial Measures” and the accompanying tables entitled “Reconciliation of GAAP to Non-GAAP Measures.”

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for EBITDAS (earnings before interest, income taxes, depreciation, amortization, and stock compensation), adjusted net income, and adjusted earnings per share data as supplemental information regarding Perficient’s business performance. Perficient believes that these non-GAAP financial measures are useful to investors because they provide investors with a better understanding of Perficient’s past financial performance and future results. Perficient’s management uses these non-GAAP financial measures when it internally evaluates the performance of Perficient’s business and makes operating decisions, including internal operating budgeting, performance measurement, and the calculation of bonuses and discretionary compensation. Management excludes stock-based compensation related to employee stock options and restricted stock awards, the amortization of intangible assets, acquisition costs, adjustments to the fair value of contingent consideration, and income tax effects of the foregoing, when making operational decisions.

Perficient believes that providing the non-GAAP financial measures to its investors is useful because it allows investors to evaluate Perficient’s performance using the same methodology and information used by Perficient’s management. Specifically, adjusted net income is used by management primarily to review business performance and determine performance-based incentive compensation for executives and other employees. Management uses EBITDAS to measure operating profitability, evaluate trends, and make strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations because they do not include all of the expenses included under GAAP and because they involve the exercise of discretionary judgment as to which charges are excluded from the non-GAAP financial measure. However, Perficient’s management compensates for these limitations by providing the relevant disclosure of the items excluded in the calculation of EBITDAS, adjusted net income, and adjusted earnings per share. In addition, some items that are excluded from adjusted net income and adjusted earnings per share can have a material impact on cash. Management compensates for these limitations by evaluating the non-GAAP measure together with the most directly comparable GAAP measure. Perficient has historically provided non-GAAP financial measures to the investment community as a supplement to its GAAP results to enable investors to evaluate Perficient’s business performance in the way that management does. Perficient’s definition may be different from similar non-GAAP financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are outlined below:

Amortization of Intangible Assets

Perficient has incurred expense on amortization of intangible assets primarily related to various acquisitions. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that eliminating this expense from its non-GAAP financial measures is useful to investors because the amortization of intangible assets can be inconsistent in amount and frequency, and is significantly impacted by the timing and magnitude of Perficient’s acquisition transactions, which also vary substantially in frequency from period to period.

Acquisition Costs

Perficient incurs transaction costs related to merger and acquisition-related activities which are expensed in its GAAP financial statements. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these expenses from its non-GAAP financial measures is useful to investors because these are expenses associated with each transaction, and are inconsistent in amount and frequency causing comparison of current and historical financial results to be difficult.

Adjustments to Fair Value of Contingent Consideration

Perficient is required to remeasure its contingent consideration liability related to acquisitions each reporting period until the contingency is settled. Any changes in fair value are recognized in earnings. Management excludes these items for the purposes of calculating adjusted net income and adjusted earnings per share. Perficient believes that excluding these adjustments from its non-GAAP financial measures is useful to investors because they are related to acquisitions, and are inconsistent in amount and frequency from period to period.

Stock-Based Compensation

Perficient incurs stock-based compensation expense under Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation. In addition, the Company adopted Accounting Standards Update No. 2016-09, Improvements to Employee Share-Based Payment Accounting, on January 1, 2016. Perficient excludes stock-based compensation expense and the related tax effects for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share because stock-based compensation is a non-cash expense, which Perficient believes is not reflective of its business performance. The nature of stock-based compensation expense also makes it very difficult to estimate prospectively, since the expense will vary with changes in the stock price and market conditions at the time of new grants, varying valuation methodologies, subjective assumptions, and different award types, making the comparison of current results with forward-looking guidance potentially difficult for investors to interpret. The tax effects of stock-based compensation expense may also vary significantly from period to period, without any change in underlying operational performance, thereby obscuring the underlying profitability of operations relative to prior periods. Perficient believes that non-GAAP measures of profitability, which exclude stock-based compensation are widely used by analysts and investors.