Exceeds consensus revenue and adjusted earnings estimates; Company raises full-year revenue and adjusted earnings outlook

ST. LOUIS (May 1, 2018) – Perficient, Inc. (NASDAQ: PRFT) (“Perficient”), the leading digital transformation consulting firm serving Global 2000® and other large enterprise customers throughout North America, today reported its financial results for the quarter ended March 31, 2018.

Financial Highlights

For the quarter ended March 31, 2018:

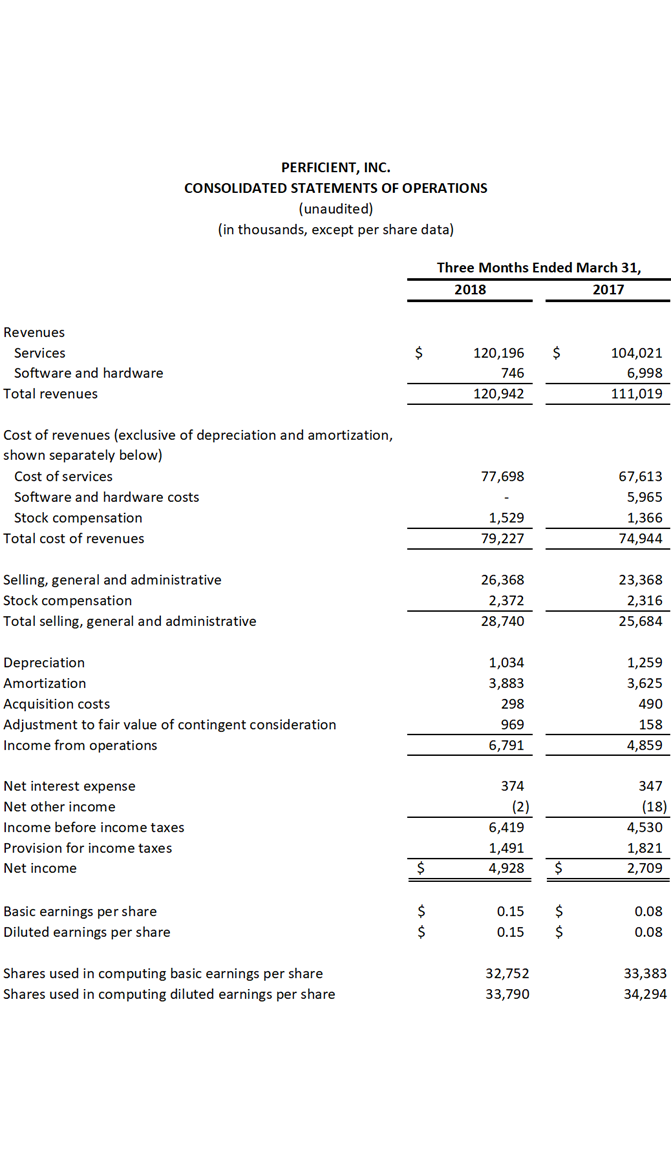

- Revenue increased 9% to $120.9 million from $111.0 million for the first quarter of 2017;

- Services revenue increased 16% to $120.2 million from $104.0 million for the first quarter of 2017;

- Net income increased 82% to $4.9 million from $2.7 million for the first quarter of 2017;

- GAAP earnings per share results on a fully diluted basis increased to $0.15 from $0.08 for the first quarter of 2017;

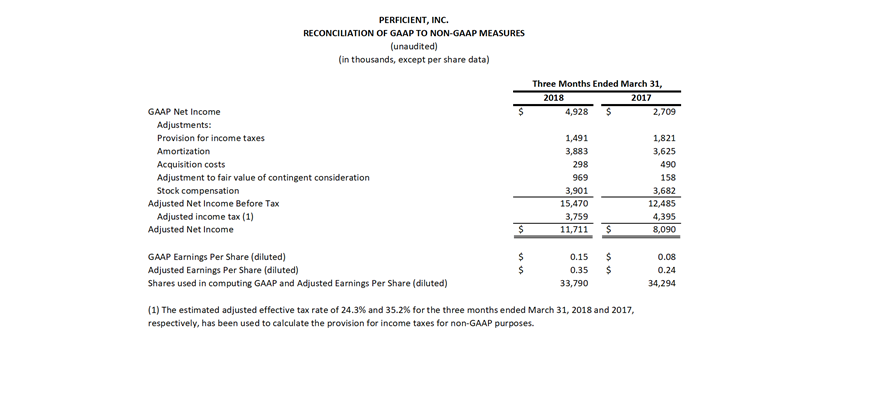

- Adjusted earnings per share results (a non-GAAP measure; see attached schedule, which reconciles to GAAP earnings per share) on a fully diluted basis increased to $0.35 from $0.24 for the first quarter of 2017; and

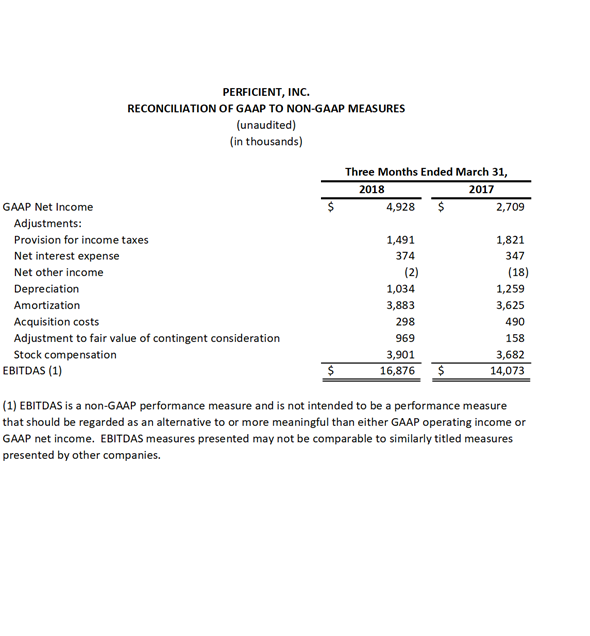

- EBITDAS (a non-GAAP measure; see attached schedule, which reconciles to GAAP net income) increased to $16.9 million from $14.1 million for the first quarter of 2017.

“Perficient delivered one of the strongest performances in its history during the first quarter,” said Jeffrey Davis, chairman and chief executive. “Our momentum entering the second quarter is solid and our confidence for the remainder of the year, coupled with results to date, enables us to raise both our revenue and adjusted earnings guidance ranges.”

Other Highlights

Among other recent achievements, Perficient:

- Strengthened its analytics, business intelligence and data warehousing capabilities with the acquisition of Southport Services Group, LLC, a Washington D.C. based consulting firm specializing in MicroStrategy platform technology implementations;

- Was named IBM’s 2018 Watson Customer Engagement Partner of the Year for Commerce; and

- Added new customer relationships and follow-on projects with such leading companies as the Auto Club Group (AAA) of Michigan, Blue Cross Blue Shield of Michigan, Caesars Entertainment, Cardtronics, Cheniere Energy, Express Scripts, Ford Motor Company, Galderma, Kirby Corporation, Mastercard, MD Anderson Cancer Center, Oshkosh, TD Ameritrade, and Trinity Health.

Business Outlook

The following statements are based on current expectations. These statements are forward-looking and actual results may differ materially. See “Safe Harbor Statement” below.

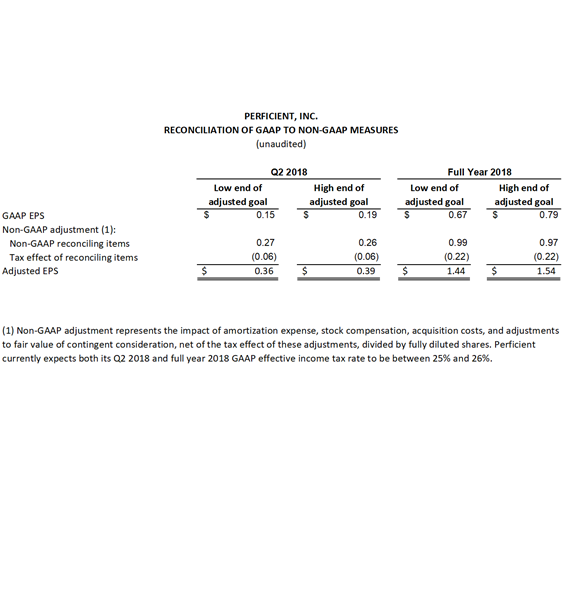

Perficient expects its second quarter 2018 revenue to be in the range of $123.0 million to $127.0 million. Second quarter adjusted earnings per share (a non-GAAP measure; see attached schedule which reconciles to GAAP earnings per share guidance) is expected to be in the range of $0.36 to $0.39.

Perficient is raising its previously provided full year 2018 revenue guidance range to $485.0 million to $510.0 million, narrowing its 2018 GAAP earnings per share guidance range to $0.67 to $0.79, and raising its 2018 adjusted earnings per share (a non-GAAP measure; see attached schedule which reconciles to GAAP earnings per share guidance) guidance range to $1.44 to $1.54.

Conference Call Details

Perficient will host a conference call regarding first quarter 2018 financial results today at 10 a.m. Eastern.

WHAT: Perficient Reports First Quarter 2018 Results

WHEN: Tuesday, May 1, 2018, at 10 a.m. Eastern

CONFERENCE CALL NUMBERS: 855-246-0403 (U.S. and Canada); 414-238-9806 (International)

PARTICIPANT PASSCODE: 2477569

REPLAY TIMES: Tuesday, May 1, 2018, at 1 p.m. Eastern, through Tuesday, May 8, 2018 at 1 p.m. Eastern

REPLAY NUMBER: 855-859-2056 (U.S. and Canada) 404-537-3406 (International)

REPLAY PASSCODE: 2477569

About Perficient

Perficient is the leading digital transformation consulting firm serving Global 2000® and enterprise customers throughout North America. With unparalleled information technology, management consulting, and creative capabilities, Perficient and its Perficient Digital agency deliver vision, execution, and value with outstanding digital experience, business optimization, and industry solutions. Our work enables clients to improve productivity and competitiveness; grow and strengthen relationships with customers, suppliers, and partners; and reduce costs. Perficient’s professionals serve clients from a network of offices across North America and offshore locations in India and China. Traded on the Nasdaq Global Select Market, Perficient is a member of the Russell 2000 index and the S&P SmallCap 600 index. Perficient is an award-winning Premier Level IBM business partner, a Microsoft National Service Provider and Gold Certified Partner, an Oracle Platinum Partner, an Adobe Premier Partner, and a Platinum Salesforce Consulting Partner. For more information, visit www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are not purely historical statements discuss future expectations or state other forward-looking information related to financial results and business outlook for 2018. Those statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on management’s current intent, belief, expectations, estimates, and projections regarding our company and our industry. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward-looking statements include (but are not limited to) those disclosed under the heading “Risk Factors” in our most recently filed annual report on Form 10-K, and the following:

(1) the possibility that our actual results do not meet the projections and guidance contained in this news release;

(2) the impact of the general economy and economic uncertainty on our business;

(3) risks associated with potential changes to federal, state, local and foreign laws, regulations and policies;

(4) risks associated with the operation of our business generally, including:

a) client demand for our services and solutions;

b) maintaining a balance of our supply of skills and resources with client demand;

c) effectively competing in a highly competitive market;

d) protecting our clients’ and our data and information;

e) risks from international operations including fluctuations in exchange rates;

f) changes to immigration policies;

g) obtaining favorable pricing to reflect services provided;

h) adapting to changes in technologies and offerings;

i) risk of loss of one or more significant software vendors;

j) making appropriate estimates and assumptions in connection with preparing our consolidated financial statements;

k) maintaining effective internal controls; and

l) changes to tax levels, audits, investigations, tax laws or their interpretation;

(5) legal liabilities, including intellectual property protection and infringement or the disclosure of personally identifiable information;

(6) risks associated with managing growth organically and through acquisitions; and

(7) the risks detailed from time to time within our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. This cautionary statement is provided pursuant to Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release are made only as of the date hereof and we undertake no obligation to update publicly any forward-looking statement for any reason, even if new information becomes available or other events occur in the future.

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”), please see the section entitled “About Non-GAAP Financial Measures” and the accompanying tables entitled “Reconciliation of GAAP to Non-GAAP Measures.”

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for EBITDAS (earnings before interest, income taxes, depreciation, amortization, stock compensation, acquisition costs and adjustment to fair value of contingent consideration), adjusted net income, and adjusted earnings per share data as supplemental information regarding Perficient’s business performance. Perficient believes that these non-GAAP financial measures are useful to investors because they provide investors with a better understanding of Perficient’s past financial performance and future results. Perficient’s management uses these non-GAAP financial measures when it internally evaluates the performance of Perficient’s business and makes operating decisions, including internal operating budgeting, performance measurement, and the calculation of bonuses and discretionary compensation. Management excludes stock-based compensation related to restricted stock awards, the amortization of intangible assets, acquisition costs, adjustments to the fair value of contingent consideration, net other income and expense, the impact of other infrequent or unusual transactions, and income tax effects of the foregoing, when making operational decisions.

Perficient believes that providing the non-GAAP financial measures to its investors is useful because it allows investors to evaluate Perficient’s performance using the same methodology and information used by Perficient’s management. Specifically, adjusted net income is used by management primarily to review business performance and determine performance-based incentive compensation for executives and other employees. Management uses EBITDAS to measure operating profitability, evaluate trends, and make strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations because they do not include all of the expenses included under GAAP and because they involve the exercise of discretionary judgment as to which charges are excluded from the non-GAAP financial measure. However, Perficient’s management compensates for these limitations by providing the relevant disclosure of the items excluded in the calculation of EBITDAS, adjusted net income, and adjusted earnings per share. In addition, some items that are excluded from adjusted net income and adjusted earnings per share can have a material impact on cash. Management compensates for these limitations by evaluating the non-GAAP measure together with the most directly comparable GAAP measure. Perficient has historically provided non-GAAP financial measures to the investment community as a supplement to its GAAP results to enable investors to evaluate Perficient’s business performance in the way that management does. Perficient’s definition may be different from similar non-GAAP financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are outlined below:

Amortization

Perficient has incurred expense on amortization of intangible assets primarily related to various acquisitions. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that eliminating this expense from its non-GAAP financial measures is useful to investors because the amortization of intangible assets can be inconsistent in amount and frequency, and is significantly impacted by the timing and magnitude of Perficient’s acquisition transactions, which also vary substantially in frequency from period to period.

Acquisition Costs

Perficient incurs transaction costs related to merger and acquisition-related activities which are expensed in its GAAP financial statements. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these expenses from its non-GAAP financial measures is useful to investors because these are expenses associated with each transaction, and are inconsistent in amount and frequency causing comparison of current and historical financial results to be difficult.

Adjustment to Fair Value of Contingent Consideration

Perficient is required to remeasure its contingent consideration liability related to acquisitions each reporting period until the contingency is settled. Any changes in fair value are recognized in earnings. Management excludes these items for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these adjustments from its non-GAAP financial measures is useful to investors because they are related to acquisitions and are inconsistent in amount and frequency from period to period.

Stock Compensation

Perficient incurs stock-based compensation expense under Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation. Perficient excludes stock-based compensation expense and the related tax effects for the purposes of calculating EBITDAS, adjusted net income, and adjusted earnings per share because stock-based compensation is a non-cash expense, which Perficient believes is not reflective of its business performance. The nature of stock-based compensation expense also makes it very difficult to estimate prospectively, since the expense will vary with changes in the stock price and market conditions at the time of new grants, varying valuation methodologies, subjective assumptions, and different award types, making the comparison of current results with forward-looking guidance potentially difficult for investors to interpret. The tax effects of stock-based compensation expense may also vary significantly from period to period, without any change in underlying operational performance, thereby obscuring the underlying profitability of operations relative to prior periods. Perficient believes that non-GAAP measures of profitability, which exclude stock-based compensation are widely used by analysts and investors.