How the Pandemic Will Change Holiday Season Shopping

A Survey of More Than 150 Enterprise Executives

The world threw a major curveball at us back in March 2020 when COVID-19 erupted on the global stage. World economies, and even our daily lives, were thrown into disarray. Many businesses that could not adapt to the new environment were forced to close, and the great majority of those that survived had to undergo dramatic changes.

As we enter the 2020 holiday season, great uncertainty remains around what to expect. It’s critical to map out your strategy and how to deal with the challenges that may present themselves over the next three months.

For that reason, we conducted a survey of 154 executives from enterprise organizations with the goal of gathering their viewpoints on what the pandemic has already changed in their businesses, what’s likely to happen this holiday season, and how they plan to prepare.

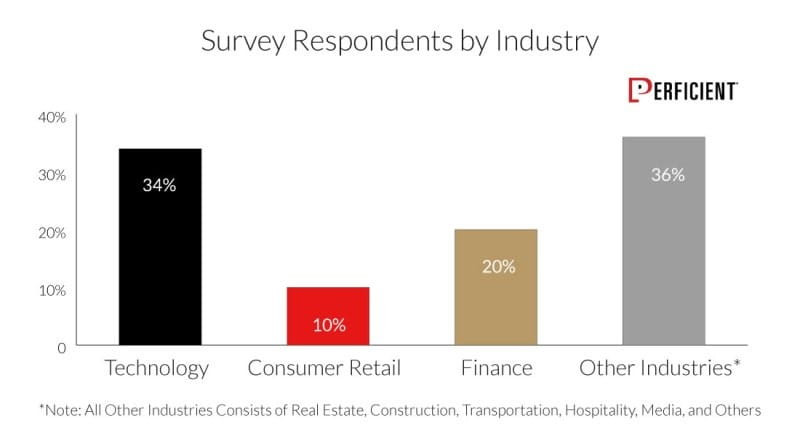

Here’s a look at the makeup of the respondents in our survey:

On-demand webinar: Eric Enge, author of this study, and Jim Hertzfeld, Chief Digital Strategist for Perficient, discussed the survey results and their meaning in a recent webinar. Watch it here.

What follows is six of the major themes we saw in analyzing the survey response data.

Agility and Business Continuity Plans

The pandemic literally threw our lives and ways of doing business into a state of turmoil, and this happened across the globe. Unprecedented changes took place at unparalleled speed. Some businesses thrived, others managed to survive, and some had to close their doors.

We learned that the market can change rapidly and in unexpected ways. Even though many organizations have tried to design themselves to be agile and have business continuity plans (BCP) in place, these may not be enough.

BCPs, for example, are designed around the goal of keeping things the same, enabling a business to keep its operations going as is despite significant changes to the environment (such as natural disasters or infrastructure availability changes).

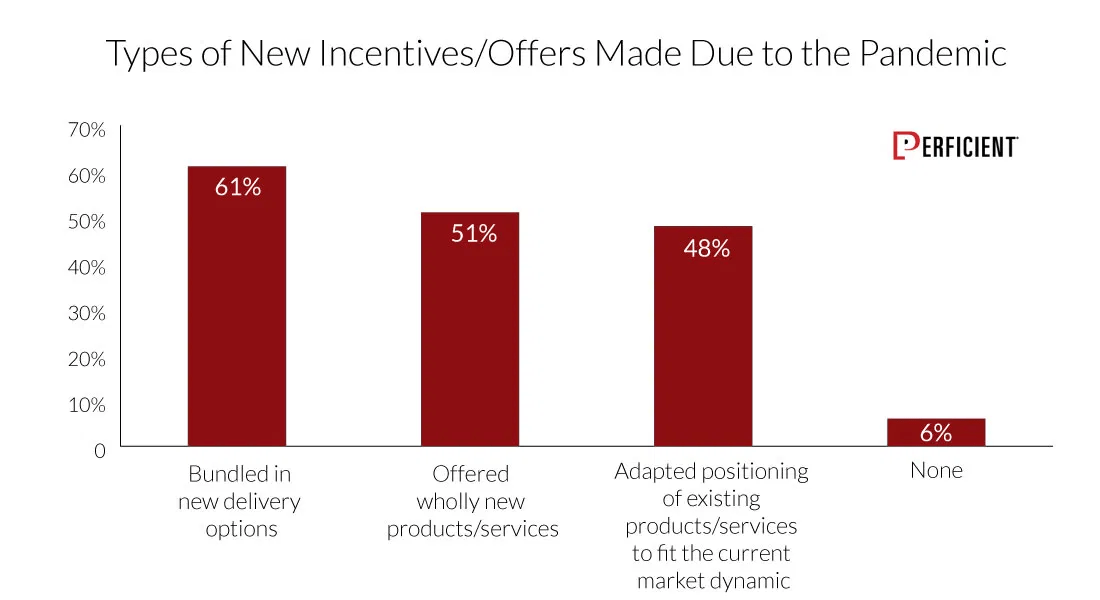

One of the questions that we asked in our survey was, “What types of new incentives or offers have you made this year in response to the pandemic? Check all that apply.”

The fact that “Bundled in new delivery options” was the top choice at 61% isn’t surprising, but “Offered wholly new products/services,” at 51%, shows us that more than half of businesses literally started selling completely new things. That’s a pretty dramatic change.

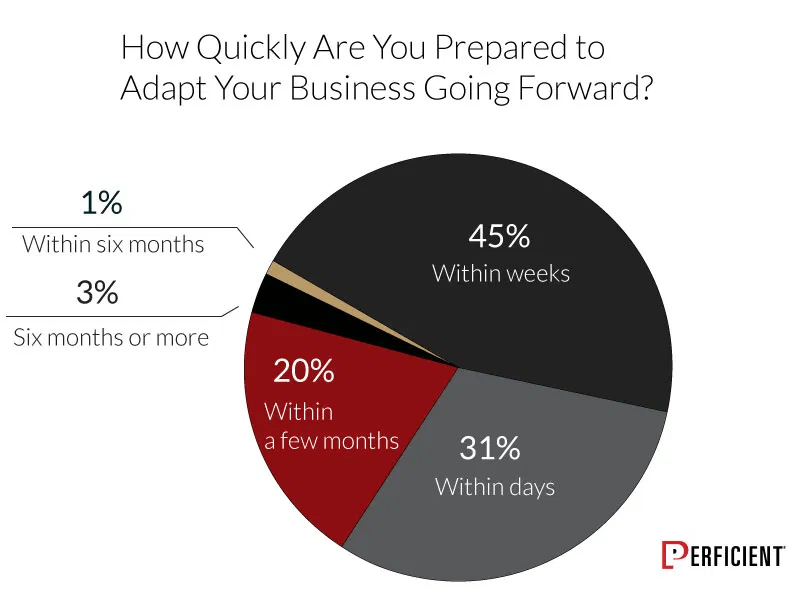

Equally important is how quickly a business is prepared to adapt. Our question along these lines asked, “How quickly are you prepared to adapt your business going forward?” Here’s how our survey participants responded:

The upshot is that 76% of respondents said they can adapt their business within weeks. . Being able to respond that quickly has become table stakes. Bear in mind, too, the nature of the new challenge may not be something you’ll anticipate or be able to bake into your BCP. For that reason, you need to have a management culture that enables rapid response.

For example, curbside pickup was likely not in anyone’s BCP. Nor was alcohol delivery, lockbox pickup, or the idea that streets and parking lots would be rezoned to allow restaurants to serve people outdoors.

That leads to the question of how you pull that off—how your business strategy team is structured and how it’s enabled to influence the business is key. If you think of strategy in a broad light, that its job is to address and resolve uncertainty and determine a path forward, and you empower your strategy team to do this, that’s a significant step.

You then need to structure your management team to move quickly during times where significant changes in strategy are required, even when fundamental changes to the business will result. Being prepared with a sound approach to your strategy and being able to pivot quickly is how you can deal with rapid change and uncertainty.

All that underscores how important it is to anticipate the unexpected and have an agile organization—which leads us to our next question.

76% of businesses say they can adapt their business within weeks in response to a pandemic.

How will this holiday season be different from a consumer perspective?

Over the past few decades, Black Friday, the day after Thanksgiving, has dominated holiday shopping. As of November 28, 2005, we also started to see Cyber Monday as one of the biggest shopping days of the year.

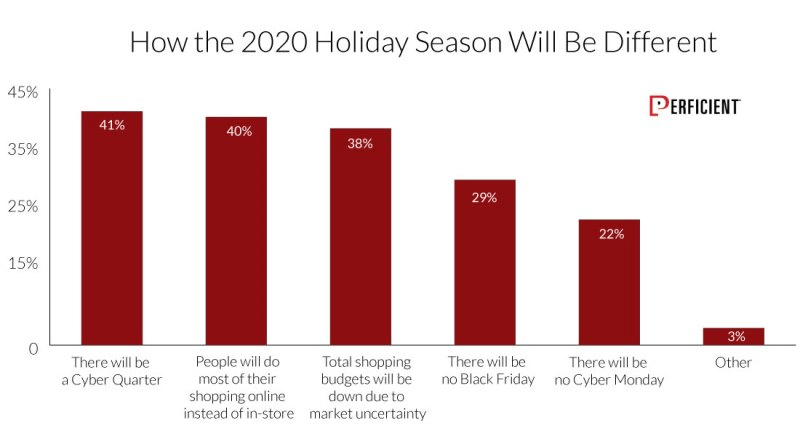

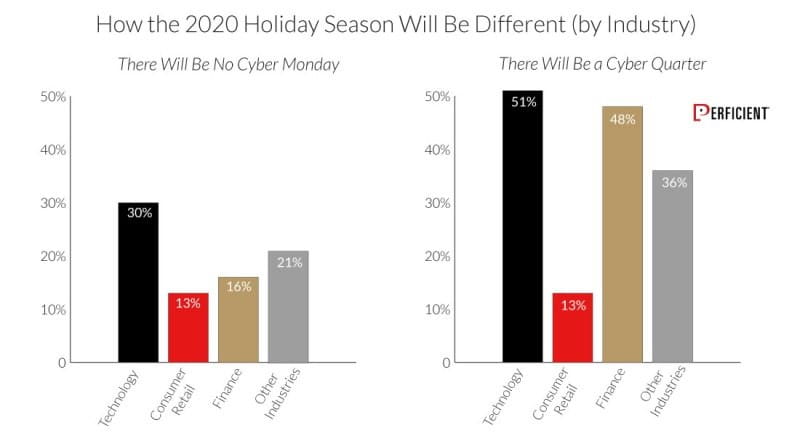

But, as with everything else in 2020, this may be a trend that will be significantly impacted. Perficient believes that business should be planning for an extended holiday season, or what we call a “Cyber Quarter.” In fact, this is supported by the responses to our question, “How do you think this holiday season will be different for consumers? Check all that apply.”

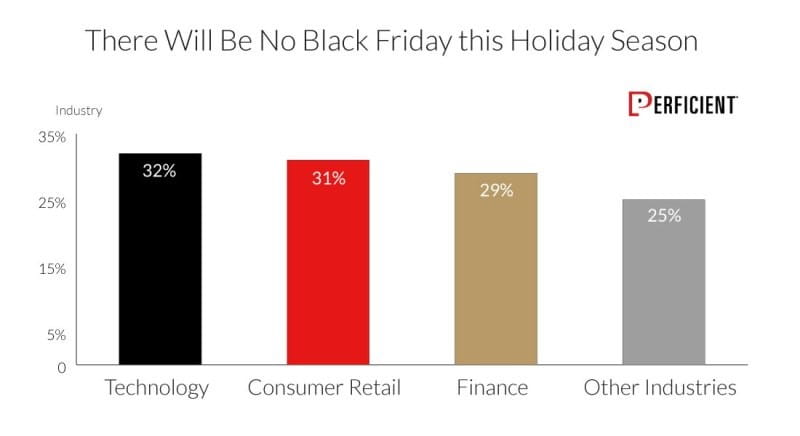

The top two responses are “There will be a Cyber Quarter” at 41%, and “People will do most of their shopping online instead of in-store” at 40%. The responses to “There will be no Black Friday” and “There will be no Cyber Monday” were a bit more muted (at 29% and 22%, respectively).

Of course, this makes a certain amount of sense, as it’s unlikely that these two concepts will go away entirely. They may not be as significant as they once were. The idea that placing all your bets on two days in a quarter may not be a wise one. This illustrates itself in the responses to another of our survey questions.

Note that “Consumer Retail” provided the lowest score for whether or not there would be a Cyber Monday, and whether or not there would be a Cyber Quarter. This indicates that respondents may continue to believe Cyber Monday will remain a huge deal. However, the responses for whether or not we would see a Black Friday by channel were much more evenly spread out across channels:

In marked contrast to this, we see the responses to whether people would do most of their shopping online instead of in-store. These data points collectively suggest to us a great deal of uncertainty on what to expect as we go into the holiday shopping season. We believe that it will be far more spread out over the entire quarter; hence, our defining the holiday shopping season as a “Cyber Quarter.” Many major players in the market are already aggressively heading in this direction. In fact, in 2020, Target, Home Depot, Walmart, Best Buy, and Kohl’s will stay closed on Thanksgiving Day and stretch out their plans for the holiday season through the entire quarter. For example, Amazon is starting deals on October 26. This is a trend that had already begun, but the pandemic has accelerated it this year

That makes sense for a number of reasons:

- Consumers were already moving more and more of their buying online, and the pandemic has greatly accelerated that trend.

- Businesses don’t necessarily benefit from having to place all their holiday bets on two days. If you get it wrong or miss the mark, your business could suffer greatly. We believe it’s smarter to play for the quarter than it is to focus all your efforts on one day.

- The rapid scaling of the volume of online buying will, in itself, bring down the importance of Black Friday—but it will also make it unreasonable to expect that consumers will, or will want to, do most of that shopping on any one given day.

- Social distancing makes it much less desirable to embrace the traditional Black Friday experience, where part of the enticement for consumers was sharing that experience with the crowds. Now, those crowds aren’t such a good thing.

- Smart businesses will figure out how to spread out the excitement and intensity. Watch for major players to offer extended special pricing that will last for the entire quarter. That will allow consumers to find what they want when they’re ready to buy.

Due to these factors, Perficient is advising its clients to adopt a much broader viewpoint this holiday season. Think about having a thriving Cyber Quarter and about the importance of agility and how quickly you will be able to respond to turbulent market conditions.

That will require you to do the following:

- Have systems in place to collect data on what’s happening in the market on a daily and weekly basis.

- Have the discipline to analyze that data, update your strategy, and make decisions on how to adapt quickly to the trends you see taking place in the market.

- Have the agility to respond dynamically across all areas of your marketing strategy. That impacts messaging, product and service offerings, pricing, and the channels that you’re using.

This is agility at a new level, but it’s what our current world requires of us as businesses. The beauty of this is that it can provide your business with a significant strategic advantage over your competition. It’s more than just a response to the pandemic–it’s setting up your business to stay ahead of the game in any market conditions.

One strategy that businesses adapted during 2020 was offering new experiences to customers. Next, we’ll explore which of those changes might become permanent, and why.

People will do most of their shopping online instead of in-store.

What changes that we saw during the pandemic will become permanent?

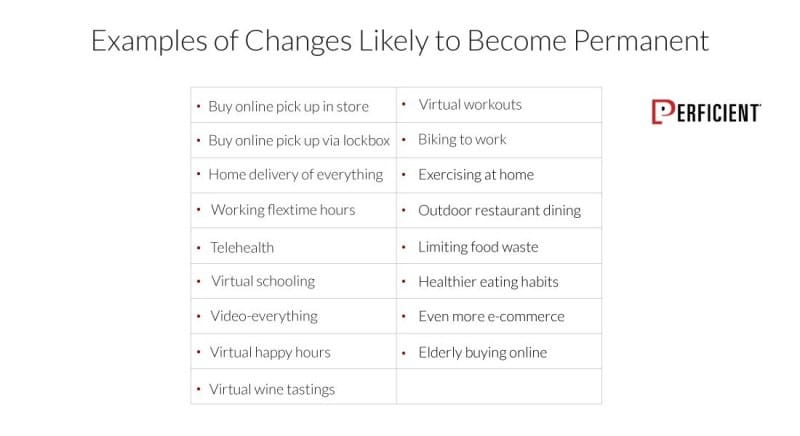

Consumers and buyers of all types were forced into many new different behaviors during the pandemic. Examples of these are as follows:

This was not just a B2C phenomenon, as large shifts were seen in B2B, B2G, and other environments such as energy and healthcare.

For example, in many B2B businesses selling is a high-touch process, where direct interaction, often face to face, is expected. However, with the advent of the pandemic, this became much less desirable, if not impossible. Much of this activity shifted over to video-based interactions, but not all of it. In some industries, the volume of self-service interactions went way up.

That also extends to B2C, where demands placed on the businesses’ websites scaled up rapidly. As you will see in our data further below, B2G businesses may have seen more of a demand shift to online than either B2B or B2C. The bottom line is that this pressure to change has impacted everyone across the board.

Regarding the shift to video, as occurs the great majority of times during the beginning of a disruptive market change, the focus has been on replacing the in-person process with the same in-video process. As we get deeper and deeper into this new modality, more and more companies will focus on finding ways to illustrate how the video experience is better than the in-person experience. This is a natural part of the market disruption lifecycle.

It’s an example of how changes that may seem temporary actually become more permanent. Some of these changes will have more difficulty becoming permanent than others, but let’s discuss a few areas of interest.

1. More delivery options — This is a lock to stay in place. Amazon was already pushing the envelope on rapid at-home delivery, and now more companies have been forced into doing this..

2. Telehealth — This is another lock to remain at a higher level than ever before. For patients, there’s no need to have to go into the doctor’s office. For doctors, there’s no need to coordinate a cycle of people coming into your office. Except in instances where a physical examination is required, this is a win for everyone. Do you need to see a specialist on the other side of the country? Not a problem at all with telehealth.

3. Working Flex Time, More Work at Home — Here’s another lock to have seen permanent growth out of the pandemic. No doubt, there is value to meeting in-person, but reducing commute times, lowering requirements for physical office space, and being able to work from the comfort of your own home are all powerful inducements. That may be bad for the commercial real estate industry, but it’s good for the environment and reducing employee stress.

4. A Growth on the Emphasis on Inside Sales — Handling more sales interactions via video enables greater ease of use in scheduling and executing meetings with your client base. And your field sales team can spend more time on your top-tier accounts.

The bottom line is that it’s essential to analyze and develop an understanding of which shifts in your business landscape are likely to sustain themselves after a COVID-19 vaccine becomes available.

Many changes in consumer behaviors are likely to become permanent after the Covid-19 pandemic.

From a consumer retail perspective, how has the buying landscape changed?

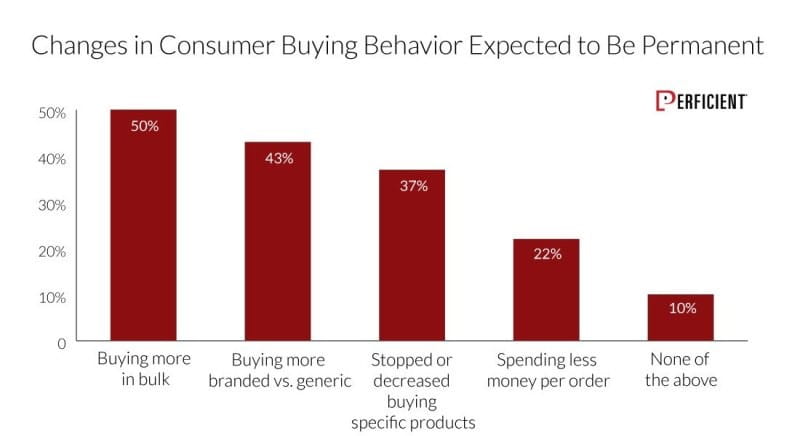

Consumer retail has seen some very significant changes as well. It’s interesting to see what our survey indicated about which areas of change would be the most significant:

Buying more in bulk (50%) and buying more branded vs. generic (43%) were the top two responses. The short message from this data is that any brands expect the shift in consumer behavior to be permanent—not only the specific experiences discussed above, but also more globally. That’s what we see with the high-ranking trends toward buying in bulk and buying brands rather than generic.

For one thing, now that people have become used to doing these things, they’ll become new habits for many. And, of course, the issues of convenience, trust, and safety remain.

The reason brand matters so much is that it plays heavily into trust. There are several factors that cause a powerful brand to be trusted, including:

1. Longevity — If you’ve been around for a while, this provides a sense of trustworthiness.

2. Relatability — An excellent example is Progressive’s Flo. Relatability like that makes you likable.

3. Authority — The reasons why this is important are obvious: you’re dealing with the best.

4. Accountability — When your company holds itself accountable, people notice.

5. Social Proof — If others like your company, that projects trust as well.

All these factors are critical in a world that feels filled with risk. Consumers want to believe they are buying from a company that will take great care in the safety and handling of their products.

The interest in buying in bulk relates to both safety and convenience. If you have to go to the store, you want to go less often, as this creates less exposure. However, if you’re buying online, you don’t have the same convenience as going to the store, where, if you’re running low on something, you can go pick it up.

When you’re buying something online, it’s not something you can replenish with the same immediacy. For that reason, you want to buy it less often. It makes for a better cycle—you buy three months of the product, and when you’re down to about a one-month supply, you repurchase it. That way, if it takes three weeks to arrive, you’re still covered.

Another interesting area of change is how businesses are investing in personalization. Since more and more activity is moving online, the competition for customers is becoming fiercer. Therefore, offering them better personalized experiences becomes more important, which leads to our next question.

The high-ranking trends in changes in consumer behaviors are toward buying in bulk and buying brands rather than generic.

How are businesses increasing their investment-related to personalization?

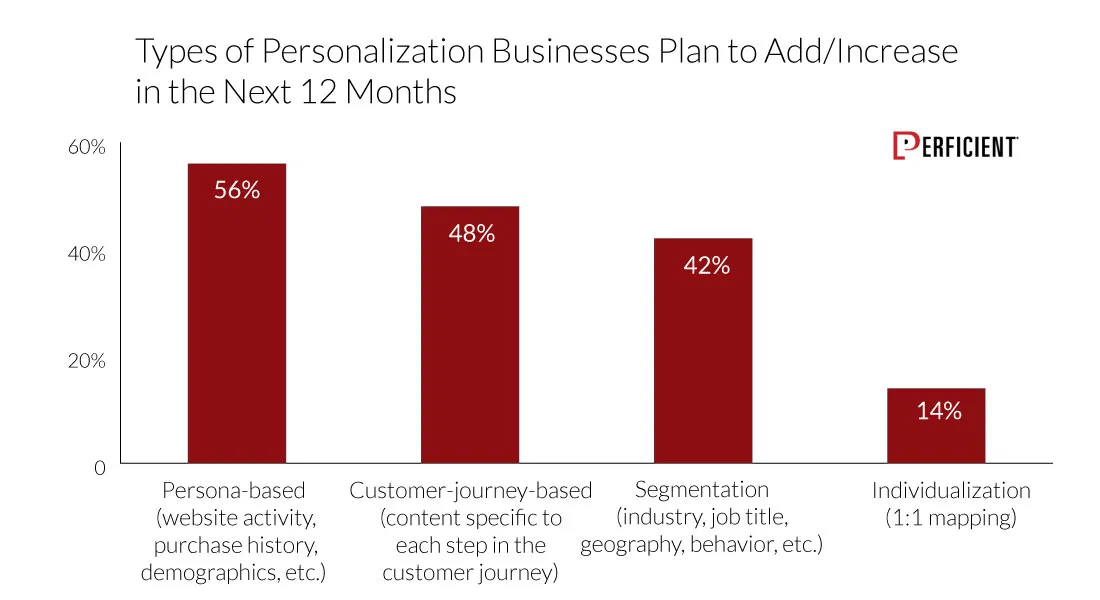

At a global level, we see that the investments here are scaling rapidly. One question we asked participants was, “Which of the following types of personalization do you plan to add or increase in the next 12 months? Check all that apply.” These are the responses:

More than half of all businesses are investing in persona-based personalization, nearly half are investing in customer-journey-based personalization, and 42% are pursuing segmentation. While this doesn’t involve every player in the market, many of your competitors are likely doing this; therefore, it’s critical that you take these things into consideration.

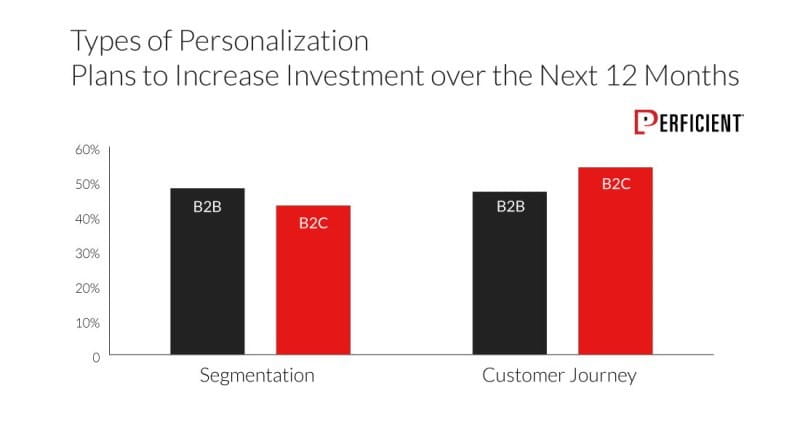

It’s also interesting to see how this plays out when comparing B2B and B2C businesses:

Here we see the natural differences between these business types. B2B companies are pursuing segmentation more than B2C companies, which may be because they likely have smaller, more targeted customer sets.

As a result, B2B players may have more ability to control and specialize their product offerings, and the customers can self-select. To be fair, there may also be some B2B players that are simply behind in their technology and infrastructure investments, and it’s incumbent upon them to work to catch up.

For B2C, where their target audience can often be quite a bit larger in number, the variety of different paths people take to purchase may vary more greatly.

Last, but not least, let’s take a more in-depth look at how companies are increasing their investment in digital marketing as a result of the pandemic.

Over 50% of all businesses are investing in persona-based personalization due to the pandemic.

How are businesses increasing their investment in digital marketing?

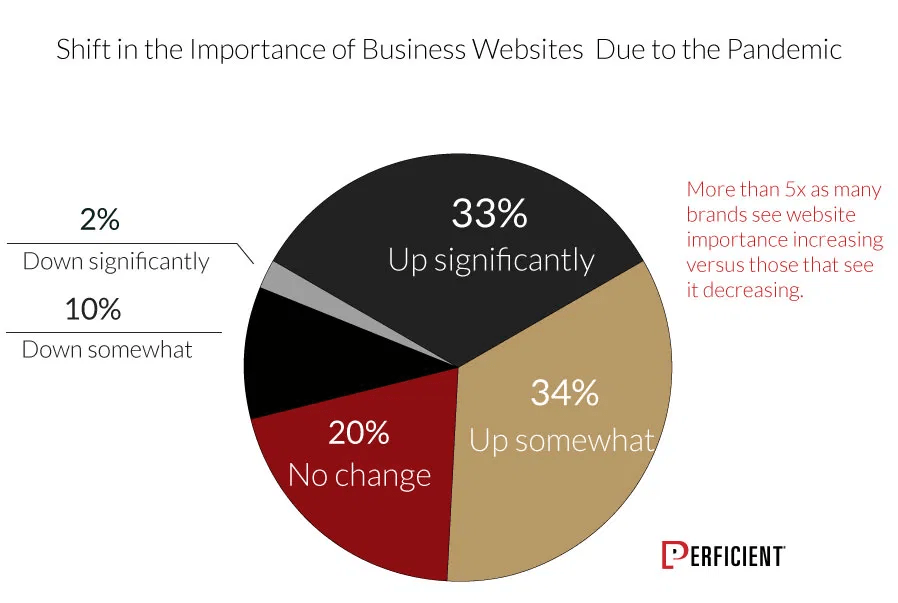

One interesting consideration is how these trends are impacting the way businesses invest in digital marketing. One of the questions we asked participants was, “How has the importance of your website shifted as you adjust to the pandemic?”

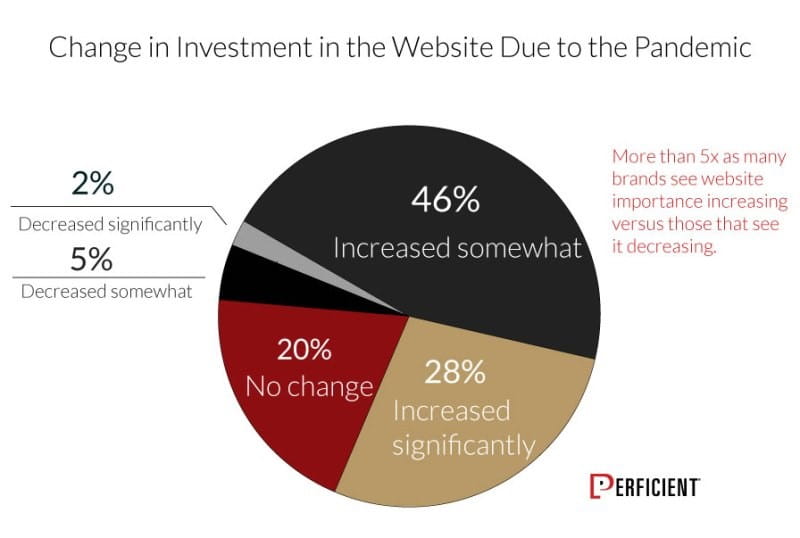

More than 5x as many brands saw increased importance (67%) than those that saw decreased importance (12%). That makes a great deal of sense and is pretty telling. Interestingly, we saw more people increasing their investment than that.

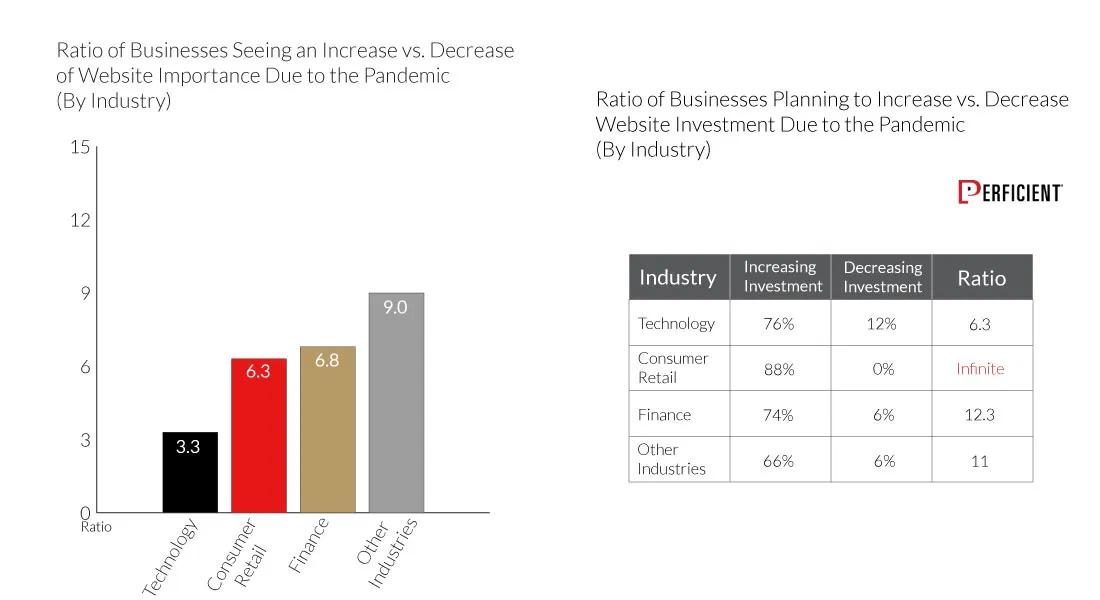

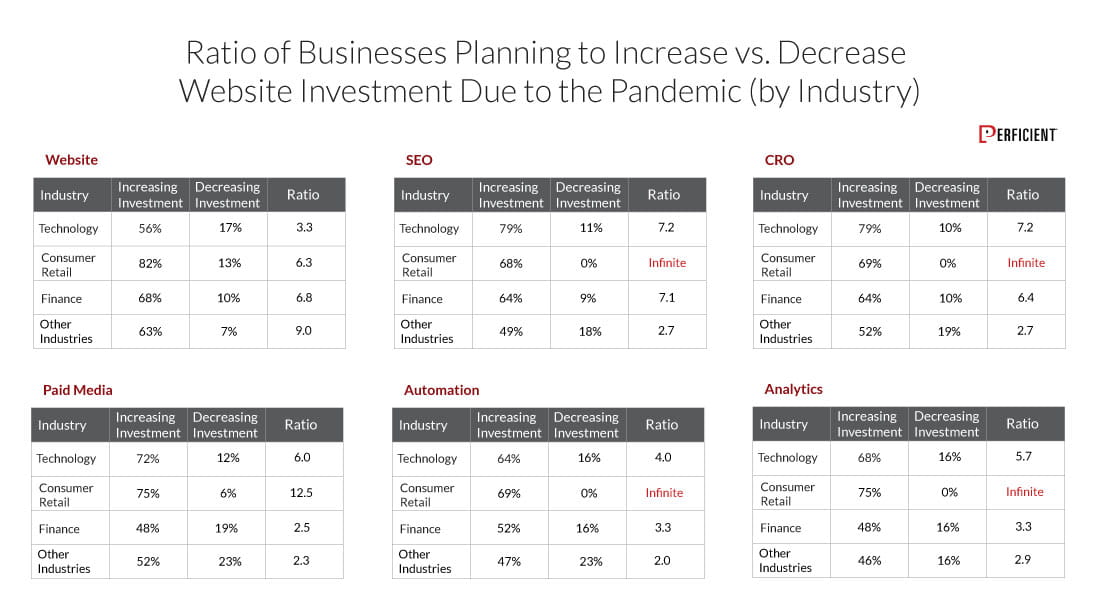

In fact, more than ten times as many people said they were increasing their investment in their website (74%) than decreasing it (7%). To better understand this, we also looked at the increased importance and increased investment in the website data based on the industry. For “Consumer Retail,” 88% of respondents said they were increasing investment, and 0% said they were decreasing it.

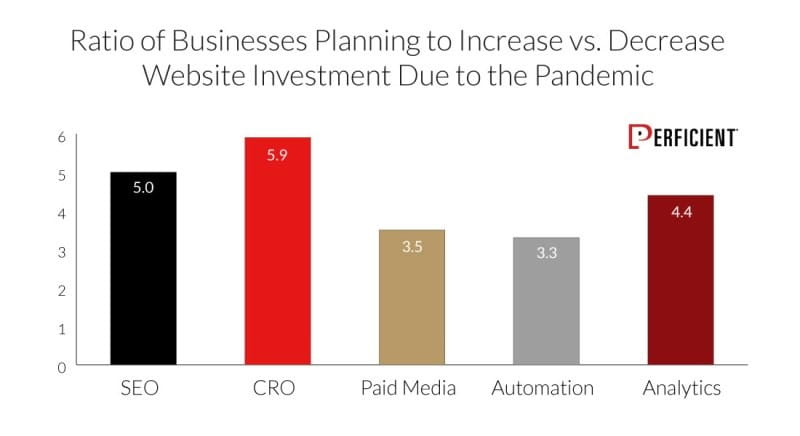

We also explored how brands shifted their investment in digital marketing by breaking it into five categories of investment.

Across SEO, CRO, paid media, automation, and analytics, we see a significant commitment to increased spend—with the lowest discipline, automation, seeing 3.3x more brands saying they’d increase it than those that said they’d decrease it.

Paid media is interesting to note, as our respondents overwhelmingly said they saw costs in this area scaling rapidly, but they’re going to spend more on it themselves anyway. This factor may also be driving their commitment to spend more in the other DM disciplines, as those areas don’t come with a cost of sales.

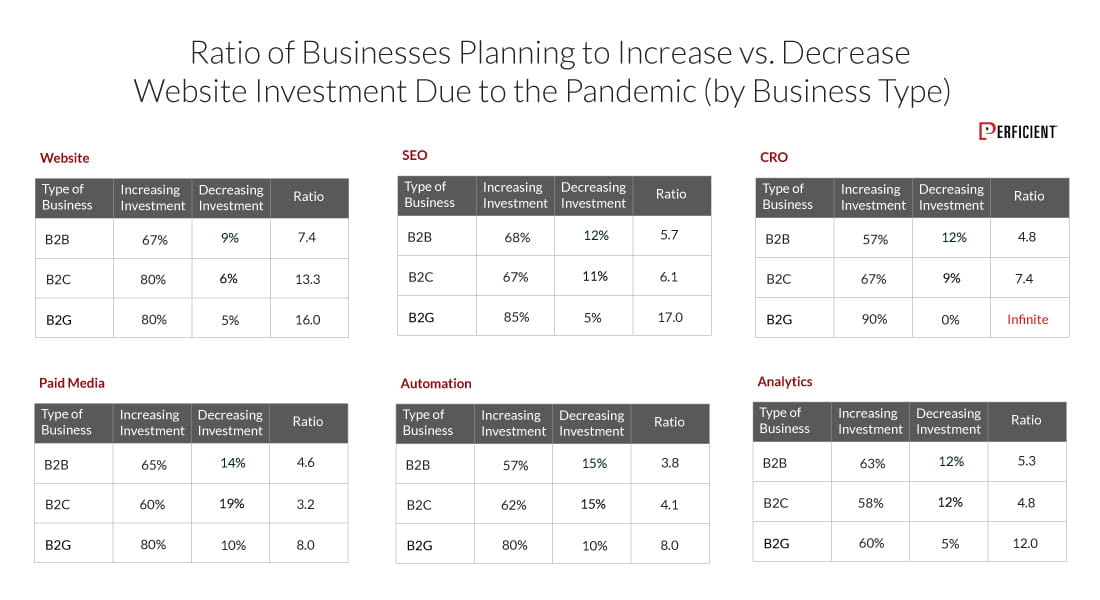

Perhaps you’re wondering if this applies to your type of business. Does it also apply to B2B and B2G businesses? Here’s what our data shows:

The short answer to that question is yes, website investment is scaling dramatically across all business types. In fact, this scaled more for B2G businesses than any other business type. Then, for one last set of data, we took this same slice across different industries.

The increase in investments by channels appears to slice strongly across all industries, with consumer retail leading the way. In fact, for many categories, more than 60% of consumer retailers said they were increasing investment, while 0% said they were decreasing it.

Cumulatively, this data tells us that the importance of digital marketing to the overall business strategy is increasing dramatically. In a world where brick-and-mortar’s role is declining, the competition for digital marketing visibility is scaling rapidly.

In principle, it’s the only game in town, so it’s best to play it to win. That means more than just throwing money at it. It involves devising smart strategies, implementing systems to measure results, and active adaptation of your investments over time. How you spread your investments across channels (SEO, CRO, paid media, and automation) should also be determined by your broader digital marketing strategy.

Determining that proper strategy and the appropriate mix of your investments is a critical part of what you need to do. However, for the overwhelming majority of businesses, one thing is clear—increasing your focus and investment in digital marketing is essential to ongoing growth during these changing market times.

88% of respondents from consumer retail industry said they were increasing investment, and 0% said they were decreasing it.

Summary - What are the key takeaways?

1. BCP and Agility — It goes without saying that you need to have a business continuity plan and need to be agile, but what should you be preparing for? The only rule around this is that there is no rule. The next challenge may be completely unexpected. You need more than a BCP on the shelf. You need a culture that can rapidly change even when faced with completely unexpected challenges.

You must also think about what’s fast enough—within weeks is the minimum requirement here, and within days is far better. The survival of your business could depend on it.

2. Here Comes the Cyber Quarter — There’s no doubt that Black Friday and Cyber Monday will still have some importance, but we believe the landscape is changing. Major players such as Amazon, Target, Walmart, and others were already moving away from focusing all of their marketing energy on two single days within the quarter, but the pandemic has accelerated that trend.

The continued decline of brick-and-mortar retail, the increased focus on ecommerce, and the massive increase in demand for delivery options will all push consumers away from making holiday buying solely about those two days. Retailers will likely be able to drive some increased demand around a shopping holiday, but overall demand will inevitably spread out over a longer period.

3. Changes That Are Here to Stay — Buyers across all business types (B2B, B2C, B2G) have been forced to learn new habits. As more time goes by, those habits are being reinforced, and people are beginning to get more comfortable with them. Many B2B and B2G buyers have gotten more comfortable with self-service. B2C buyers have gotten used to BOPIS, home delivery, and buying things online that they used to buy in-store.

The changes are much broader than that, of course. People are used to working out at home instead of going to the gym. The demand for office space has taken a big hit Nearly everyone has become more adept at doing things via video. The list of new behavior patterns that are becoming ingrained in us is long.

That means that when “things return to normal,” we will be looking at a new normal. It’s critical that you target your return to normal at that new normal. For example, if video will play a much more significant part in how you interact with customers, how can you take that video experience and do much more with it than use it as a substitute for in-person? What can video do better than what can be done in- person?

You need to apply this thought process to everything likely to become a permanent change in your landscape.

4. Changes in Buying Behavior — The scope of these changes extends into other aspects of how you engage with your customers. The increased focus on buying in bulk has broad implications for supply chain, how you package products, and how you distribute them.

Further, the increased focus on buying from brands and the need consumers feel about dealing with entities they trust has a substantial impact on how we invest in marketing. Building and cultivating the brand become far more important than they already were. And, in a world that lives largely online, online reputation management potentially becomes a much bigger thing.

5. Demand for Increased Personalization — One of the more critical aspects of dealing with disruptive changes in how people behave is to look beyond simply asking a new experience to do the same thing as the old experience. In other words, it’s critical to consider what a new experience can do differently and better than the old one.

One area of potential is personalization. An in-store shopping experience may seem more personal at a high level, as you get person-to-person interactions. However, unless the salesperson really gets to know you, personalization is not something that sustains itself between shopping trips.

Enter personalization. Leveraging persona models is table stakes at this point, and moving into segmentation and/or journey mapping is the next stage of creating a better shopping experience online. Even individualization is being pursued by many participants in our survey.

The bottom line here is that you need to be thinking about making the online shopping experience better than the in-store experience, but not just because it’s faster and more convenient.

6. Website/Digital Marketing Importance — A year ago, you might not have anticipated that your website would suddenly become much more important than it was, but that’s exactly what happened. And, this shift is not reverting. A large number of buyers who were not into the ecommerce experience, or who used it in limited ways, were forced to adapt it more heavily. This cut across all business types—B2B, B2C, and B2G. That means all the various forms of digital marketing have risen in importance.

You must be prepared to invest even more in these areas. As our data shows, the great majority of your competitors have likely increased their investments in all five areas we asked about (SEO, CRO, paid media, automation, and analytics), so you’re at risk of getting left far behind if you don’t do the same.