Record North American Bill Rates and Strong Utilization Power Profitability

ST. LOUIS (July 30, 2020) - Perficient, Inc. (Nasdaq: PRFT) (“Perficient”), the leading global digital consultancy transforming the world’s largest enterprises and biggest brands, today reported its financial results for the quarter ended June 30, 2020.

Financial Highlights

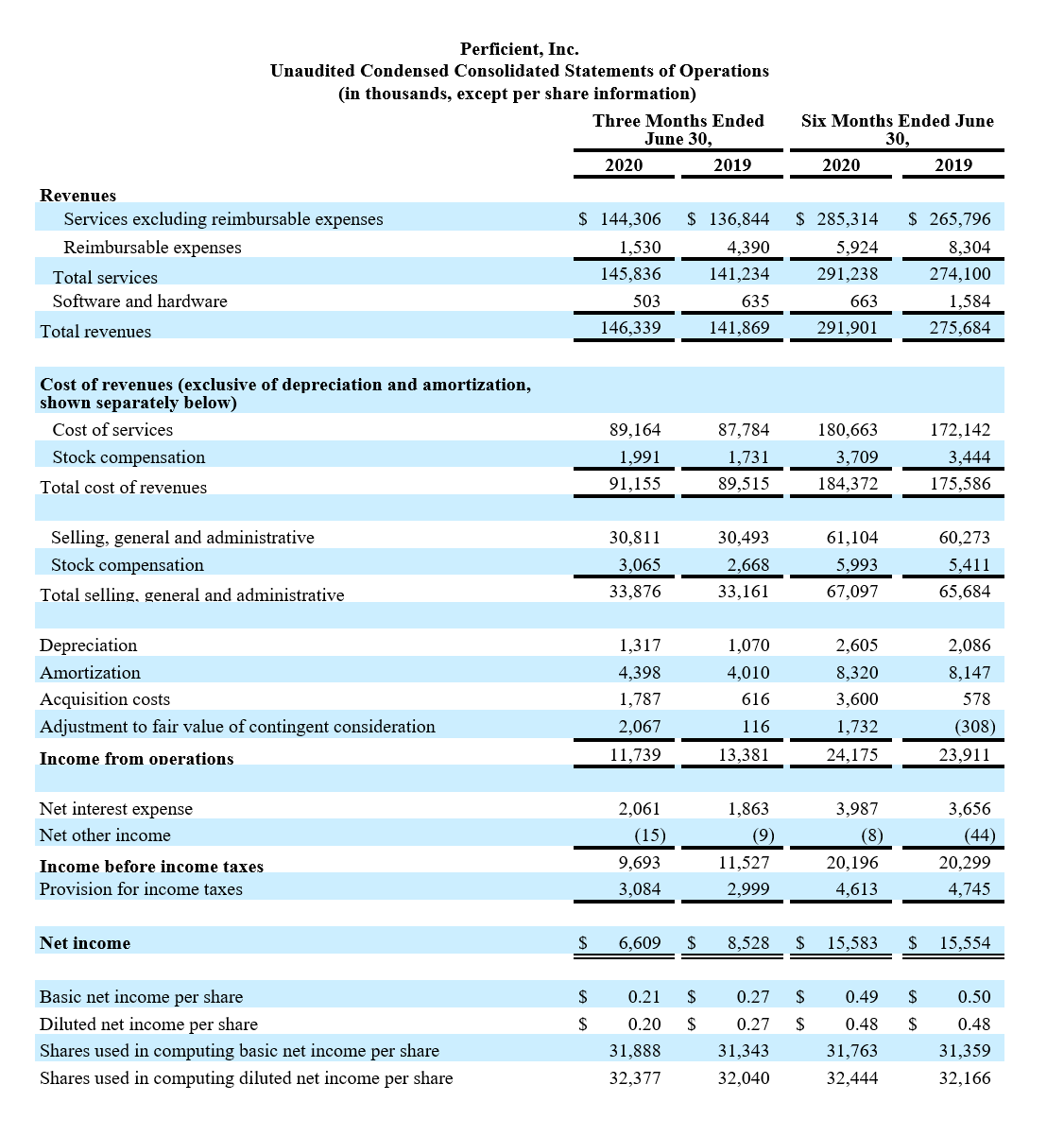

For the quarter ended June 30, 2020:

- Services revenues net of reimbursed expenses increased 5% to $144.3 million from $136.8 million in the second quarter of 2019;

- Total revenues increased 3% to $146.3 million from $141.9 million in the second quarter of 2019;

- Net income decreased 23% to $6.6 million from $8.5 million in the second quarter of 2019;

- GAAP earnings per share results on a fully diluted basis decreased 26% to $0.20 from $0.27 in the second quarter of 2019;

- Adjusted earnings per share results (a non-GAAP measure; see attached schedule, which reconciles to GAAP earnings per share) on a fully diluted basis increased 10% to $0.57 from $0.52 in the second quarter of 2019; and

- Adjusted EBITDA (a non-GAAP measure; see attached schedule, which reconciles to GAAP net income) increased 12% to $26.4 million from $23.6 million in the second quarter of 2019.

“Perficient is not only persevering through the business challenges presented by COVID-19, we’re thriving,” said Jeffrey Davis, chairman and CEO. “Impressive utilization, strong average billing rates, and solid bookings including several net new client wins powered a performance our entire team is proud of. Beyond that, we completed the largest acquisition in our history, welcoming more than 600 nearshore colleagues based in Latin America to our team in a development that immediately and substantially grows our capacity to serve our enterprise clients with global talent.”

Other Highlights

Among other recent achievements, Perficient:

- Expanded its global presence in South America through the acquisition of PSL, a $33 million annual revenue nearshore software development company based in Medellin, Colombia, with additional locations in Bogota and Cali, Colombia;

- Announced that Nancy Pechloff has been appointed an independent member of the company’s Board of Directors. Ms. Pechloff formerly served as a Senior Managing Director at Protiviti, and brings more than 40 years of experience related to internal controls, corporate governance, Sarbanes-Oxley compliance, and finance across a variety of industries;

- Received a 2020 Microsoft Health Innovation Award for enabling personalized care with one of the largest healthcare systems in the United States;

- Announced that Andrea Lampert joined the company as Vice President of People. With experience leading in environments of rapid change and growth, both organic and through mergers and acquisitions, Ms. Lampert is responsible for driving the implementation of strategic HR objectives that focus on the people experience;

- Was included in the Forrester “Now Tech: Oracle Apps Implementation Service Providers, Q2 2020” report as an implementation service provider supporting clients as they shift to Oracle Cloud; and

- Added new customer relationships and follow-on projects with leading companies including Ascension Health, Ashley Furniture, Cargill Incorporated, CIGNA Corporation, Essex Property Trust, Herbalife Nutrition, Nestle USA, Porsche, Qualcomm, Sempra Energy, Takeda Pharmaceutical Company, TCF Bank, TD Ameritrade, The Capital Group, and Toyota Motor North America, among others.

Business Outlook

In light of the uncertain duration and scope of the pandemic and its impact on economic and financial markets, we cannot reliably predict the impact of the pandemic on our business, operations or financial results. Accordingly, we have determined not to issue guidance at this time.

Conference Call Details

Perficient will host a conference call regarding second quarter 2020 financial results today at 11 a.m. Eastern.

WHEN: Thursday, July 30, 2020, at 11 a.m. Eastern

CONFERENCE CALL NUMBERS: 855-246-0403 (U.S. and Canada); 414-238-9806 (International)

PARTICIPANT PASSCODE: 3778686

REPLAY TIMES: July 30, 2020, at 2 p.m. Eastern, through Thursday, Aug. 6, 2020, at 2 p.m. Eastern

REPLAY NUMBER: 855-859-2056 (U.S. and Canada); 404-537-3406 (International)

REPLAY PASSCODE: 3778686

About Perficient

Perficient is a leading global digital consultancy. We imagine, create, engineer, and run digital transformation solutions that help our clients exceed customers’ expectations, outpace competition, and grow their business. With unparalleled strategy, creative, and technology capabilities, we bring big thinking and innovative ideas, along with a practical approach to help the world’s largest enterprises and biggest brands succeed. Traded on the Nasdaq Global Select Market, Perficient is a member of the Russell 2000 index and the S&P SmallCap 600 index. Perficient is an award-winning Adobe Platinum Partner, Platinum Level IBM business partner, a Microsoft National Service Provider and Gold Certified Partner, an Oracle Platinum Partner, a Gold Salesforce Consulting Partner, a Sitecore Platinum Partner, and a VMware Authorized Partner. For more information, visit www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are not purely historical statements discuss future expectations or state other forward-looking information related to financial results and business outlook for 2020. Those statements are subject to known and unknown risks, uncertainties, and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on management’s current intent, belief, expectations, estimates, and projections regarding our company and our industry. You should be aware that those statements only reflect our predictions. Actual events or results may differ substantially. Important factors that could cause our actual results to be materially different from the forward-looking statements include (but are not limited to) those disclosed under the heading “Risk Factors” in our most recently filed annual report on Form 10-K as supplemented by the Risk Factors contained in Part II, Item 1A of our Quarterly Reports on Form 10-Q filed on May 7, 2020 and July 30, 2020, respectively, and the following, many of which are, or may be, amplified by the novel coronavirus (COVID-19) pandemic:

(1) the possibility that our actual results do not meet the projections and guidance contained in this news release;

(2) the impact of the COVID-19 pandemic on our business;

(3) the impact of the general economy and economic and political uncertainty on our business;

(4) risks associated with potential changes to federal, state, local and foreign laws, regulations and policies;

(5) risks associated with the operation of our business generally, including:

a) client demand for our services and solutions;

b) maintaining a balance of our supply of skills and resources with client demand;

c) effectively competing in a highly competitive market;

d) protecting our clients’ and our data and information;

e) risks from international operations including fluctuations in exchange rates;

f) changes to immigration policies;

g) obtaining favorable pricing to reflect services provided;

h) adapting to changes in technologies and offerings;

i) risk of loss of one or more significant software vendors;

j) making appropriate estimates and assumptions in connection with preparing our consolidated financial statements;

k) maintaining effective internal controls; and

(6) risks associated with managing growth organically and through acquisitions;

(7) risks associated with servicing our debt, the potential impact on the value of our common stock from the conditional conversion features of our debt and the associated convertible note hedge transactions;

(8) legal liabilities, including intellectual property protection and infringement or the disclosure of personally identifiable information; and

(9) the risks detailed from time to time within our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. This cautionary statement is provided pursuant to Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release are made only as of the date hereof and we undertake no obligation to update publicly any forward-looking statement for any reason, even if new information becomes available or other events occur in the future.

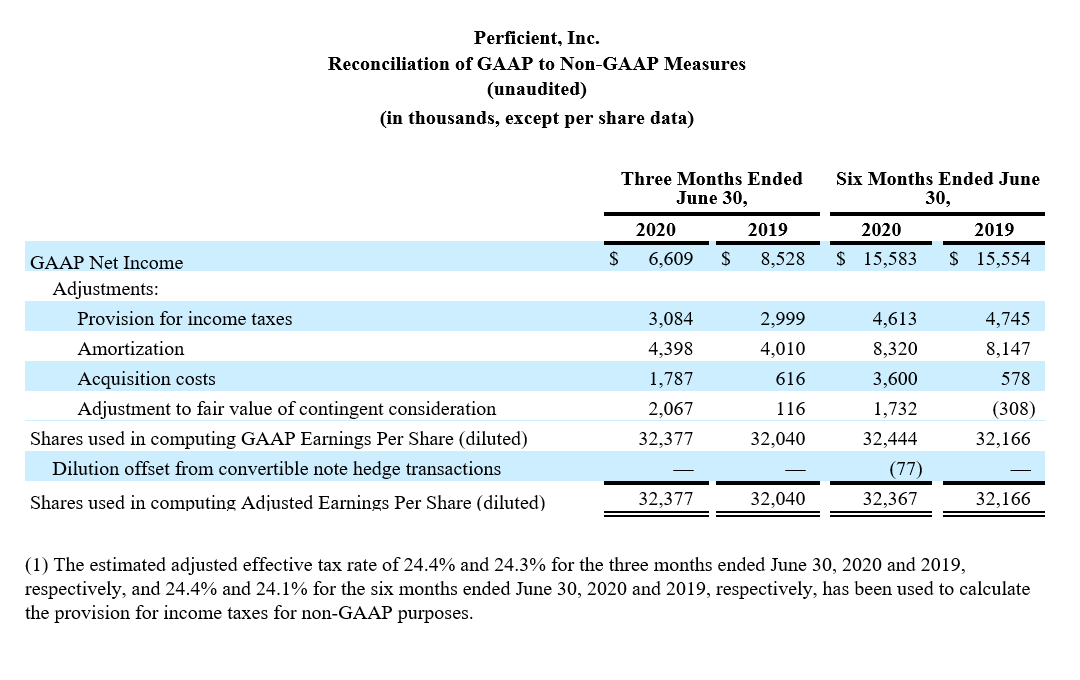

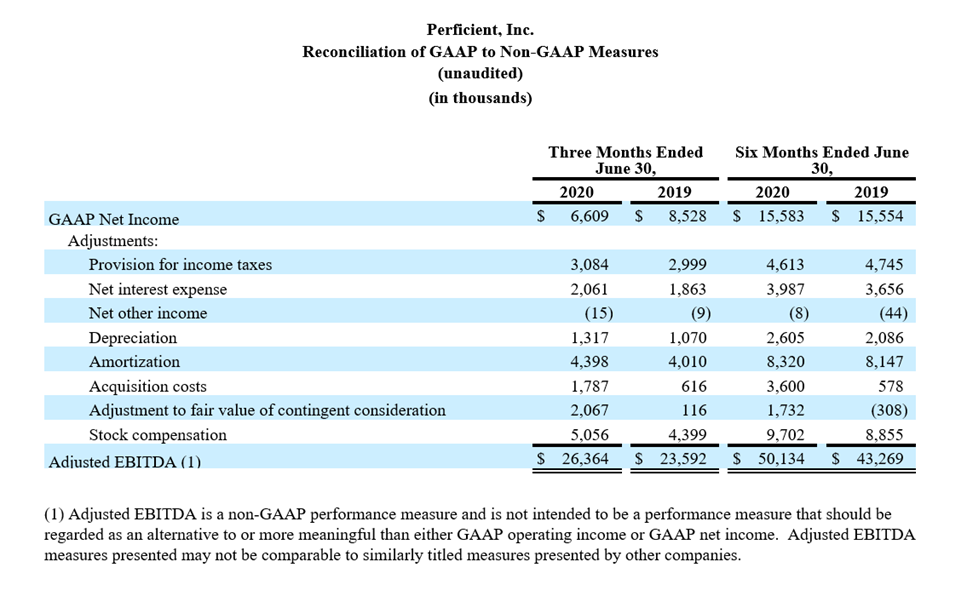

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”), please see the section entitled “About Non-GAAP Financial Measures” and the accompanying tables entitled “Reconciliation of GAAP to Non-GAAP Measures.”

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, stock compensation, acquisition costs and adjustment to fair value of contingent consideration), adjusted net income, and adjusted earnings per share data as supplemental information regarding Perficient’s business performance. Perficient believes that these non-GAAP financial measures are useful to investors because they provide investors with a better understanding of Perficient’s past financial performance and future results. Perficient’s management uses these non-GAAP financial measures when it internally evaluates the performance of Perficient’s business and makes operating decisions, including internal operating budgeting, performance measurement, and the calculation of bonuses and discretionary compensation. Management excludes stock-based compensation related to restricted stock awards, the amortization of intangible assets, amortization of debt discounts and issuance costs related to convertible senior notes, acquisition costs, adjustments to the fair value of contingent consideration, net other income and expense, the impact of other infrequent or unusual transactions, and income tax effects of the foregoing, when making operational decisions.

Perficient believes that providing the non-GAAP financial measures to its investors is useful because it allows investors to evaluate Perficient’s performance using the same methodology and information used by Perficient’s management. Specifically, adjusted net income is used by management primarily to review business performance and determine performance-based incentive compensation for executives and other employees. Management uses adjusted EBITDA to measure operating profitability, evaluate trends, and make strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations because they do not include all of the expenses included under GAAP and because they involve the exercise of discretionary judgment as to which charges are excluded from the non-GAAP financial measure. However, Perficient’s management compensates for these limitations by providing the relevant disclosure of the items excluded in the calculation of adjusted EBITDA, adjusted net income, and adjusted earnings per share. In addition, some items that are excluded from adjusted net income and adjusted earnings per share can have a material impact on cash. Management compensates for these limitations by evaluating the non-GAAP measure together with the most directly comparable GAAP measure. Perficient has historically provided non-GAAP financial measures to the investment community as a supplement to its GAAP results to enable investors to evaluate Perficient’s business performance in the way that management does. Perficient’s definition may be different from similar non-GAAP financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are outlined below:

Amortization

Perficient has incurred expense on amortization of intangible assets primarily related to various acquisitions. Management excludes these items for the purposes of calculating adjusted EBITDA, adjusted net income, and adjusted earnings per share. Perficient believes that eliminating this expense from its non-GAAP financial measures is useful to investors because the amortization of intangible assets can be inconsistent in amount and frequency, and is significantly impacted by the timing and magnitude of Perficient’s acquisition transactions, which also vary substantially in frequency from period to period.

Acquisition Costs

Perficient incurs transaction costs related to merger and acquisition-related activities which are expensed in its GAAP financial statements. Management excludes these items for the purposes of calculating adjusted EBITDA, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these expenses from its non-GAAP financial measures is useful to investors because these are expenses associated with each transaction and are inconsistent in amount and frequency causing comparison of current and historical financial results to be difficult.

Adjustment to Fair Value of Contingent Consideration

Perficient is required to remeasure its contingent consideration liability related to acquisitions each reporting period until the contingency is settled. Any changes in fair value are recognized in earnings. Management excludes these items for the purposes of calculating adjusted EBITDA, adjusted net income, and adjusted earnings per share. Perficient believes that excluding these adjustments from its non-GAAP financial measures is useful to investors because they are related to acquisitions and are inconsistent in amount and frequency from period to period.

Amortization of Debt Discount and Debt Issuance Costs

On September 11, 2018, Perficient issued $143.8 million aggregate principal amount of 2.375% Convertible Senior Notes due 2023 (the “Notes”) in a private placement to qualified institutional purchasers. In accordance with accounting for debt with conversions and other options, Perficient bifurcated the principal amount of the Notes into liability and equity components. The resulting debt discount is being amortized to interest expense over the period from the issuance date through the contractual maturity date of September 15, 2023. Issuance costs related to the Notes were allocated pro rata based on the relative fair values of the liability and equity components. Issuance costs attributable to the liability component of the Notes, in addition to issuance costs related to Perficient’s credit agreement, are being amortized to interest expense over their respective terms. Perficient believes that excluding these non-cash expenses from its non-GAAP financial measures is useful to investors because the expenses are not reflective of the company’s business performance.

Stock Compensation

Perficient incurs stock-based compensation expense under Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation - Stock Compensation. Perficient excludes stock-based compensation expense and the related tax effects for the purposes of calculating adjusted EBITDA, adjusted net income, and adjusted earnings per share because stock-based compensation is a non-cash expense, which Perficient believes is not reflective of its business performance. The nature of stock-based compensation expense also makes it very difficult to estimate prospectively, since the expense will vary with changes in the stock price and market conditions at the time of new grants, varying valuation methodologies, subjective assumptions, and different award types, making the comparison of current results with forward-looking guidance potentially difficult for investors to interpret. The tax effects of stock-based compensation expense may also vary significantly from period to period, without any change in underlying operational performance, thereby obscuring the underlying profitability of operations relative to prior periods. Perficient believes that non-GAAP measures of profitability, which exclude stock-based compensation are widely used by analysts and investors.

Dilution Offset from Convertible Note Hedge Transactions

It is Perficient’s current intent to settle conversions of the Notes through combination settlement, which involves repayment of the principal portion in cash and any excess of the conversion value over the principal amount in shares of our common stock. We exclude the shares that are issuable upon conversions of the Notes because we expect that the dilution from such shares will be offset by the convertible note hedge transactions entered into in September 2018 in connection with the issuance of the Notes.