Captive Finance in Automotive

A Perficient Strategic Position

Digital Transformation Creates New Opportunities for Automotive Captives

What Is Captive Finance in Automotive?

Everything that OEM captives have built—revenues, market share, brand value—is potentially at risk, or is at least going to change, because of mobility transformation.

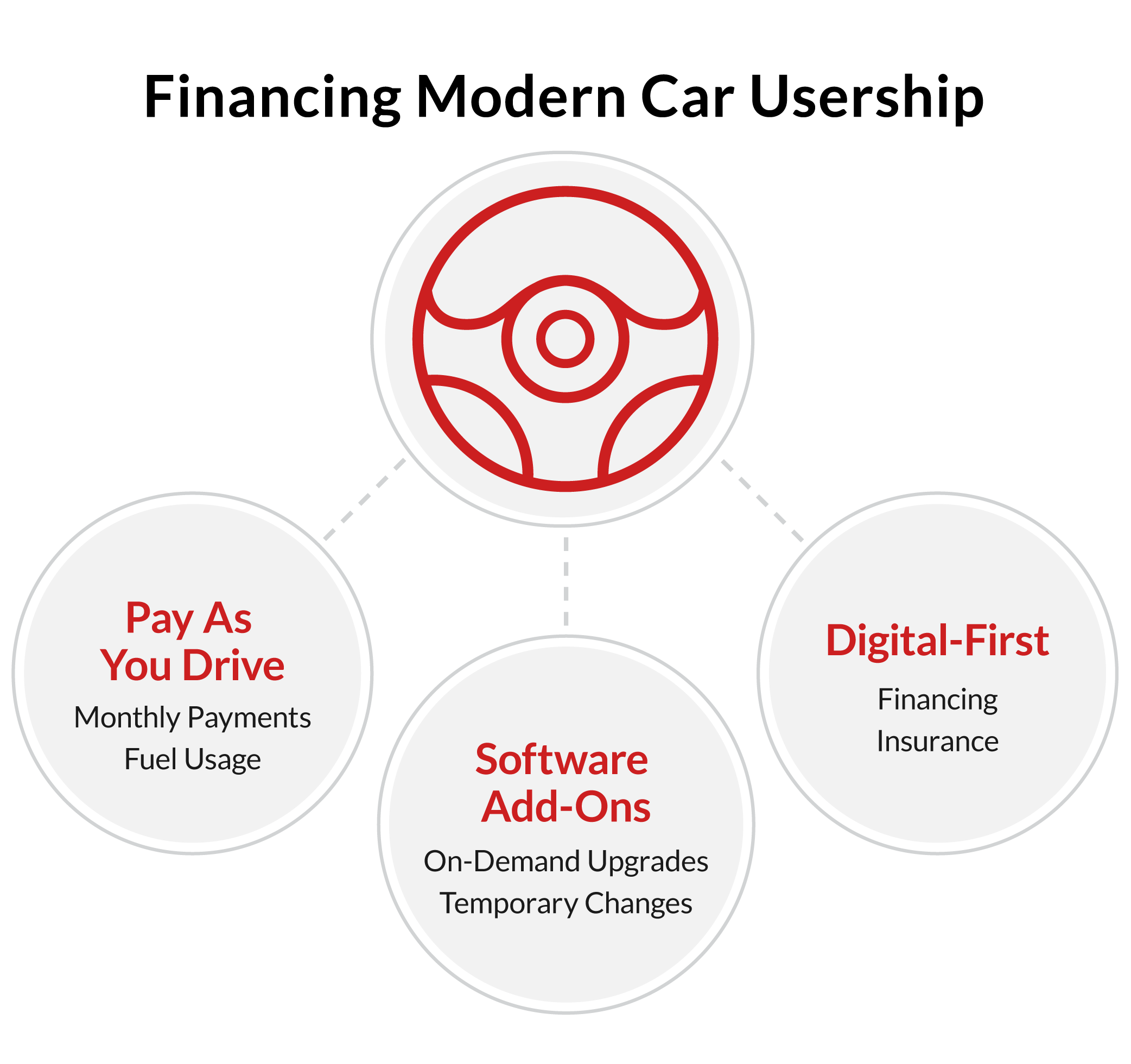

Automotive captives can improve the most important parts of the driver experience: the ownership of the car and the usership of emerging new services.

For decades, the automotive captive finance business has been stable and lucrative. However, regulatory changes, the digitalization of financing, and other disruptors challenge the status quo and will require significant business transformation. Automotive manufacturers must offer new products and services that efficiently and cost-effectively meet customers’ changing transportation preferences.

Captives need to build their own payment functionalities and leverage enormous amounts of data. At the same time, they need to capture customer loyalty with valuable services that utilize personal and vehicle-related data.

Making these changes will enable legacy captives to outperform incumbents and new market entrants and secure dominance in the market.