Financial Forecast Simulations

A Perficient Strategic Position

The Art of Margin Sensitivity Simulations in a Tariff Environment

What are Financial Forecast Simulations?

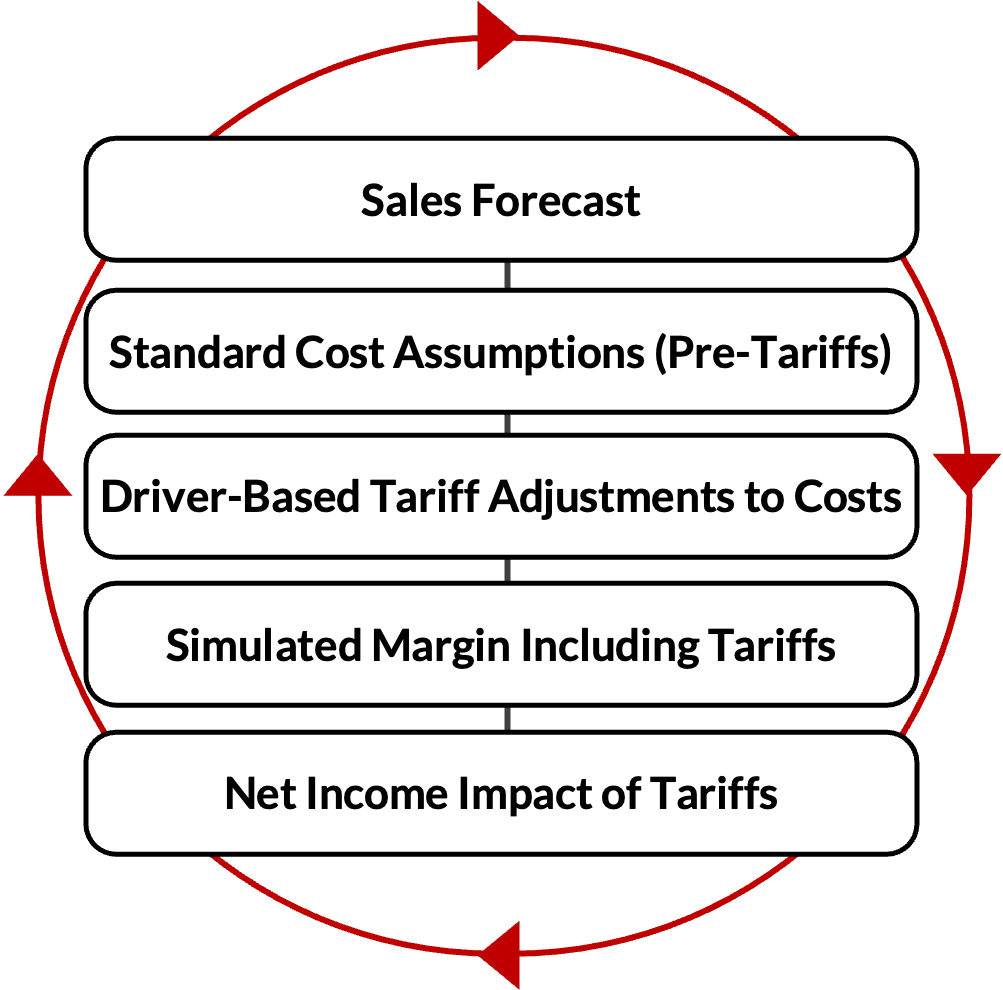

Forecast simulations enable companies to model how shifting market conditions might affect profitability. This capability is particularly crucial for mitigating the impact of tariffs on profitability.

Designing forecast models incorporating tariff assumptions on standard costs enables sensitivity analysis at the levels needed to understand the impact on profitability, assuming constant SG&A expenses.

Understanding the potential impact of new tariffs is essential for deciding strategies to maintain or grow profitability. Businesses need a flexible driver-based forecast model that can simulate impacts on sales and costs.

Margin sensitivity analysis simulates the impact of tariffs on costs. In most industries, forecast models are based on standard costs and include direct materials, direct labor, and certain overheads. Updating standard costs is complex and time consuming and is only performed once or twice per fiscal year.

Companies that cannot model tariff impacts in their forecasts will be at a competitive disadvantage.

Profitable outcomes in a tariff environment depend on a driver-based forecast model that incorporates tariff impacts into standard costs, simulating margins and net income while maintaining constant SG&A expenses.

Cost drivers should flex by product type to capture relevant increases in materials or parts. Sales drivers can simulate the effect on volumes, should selling price increases also be considered.